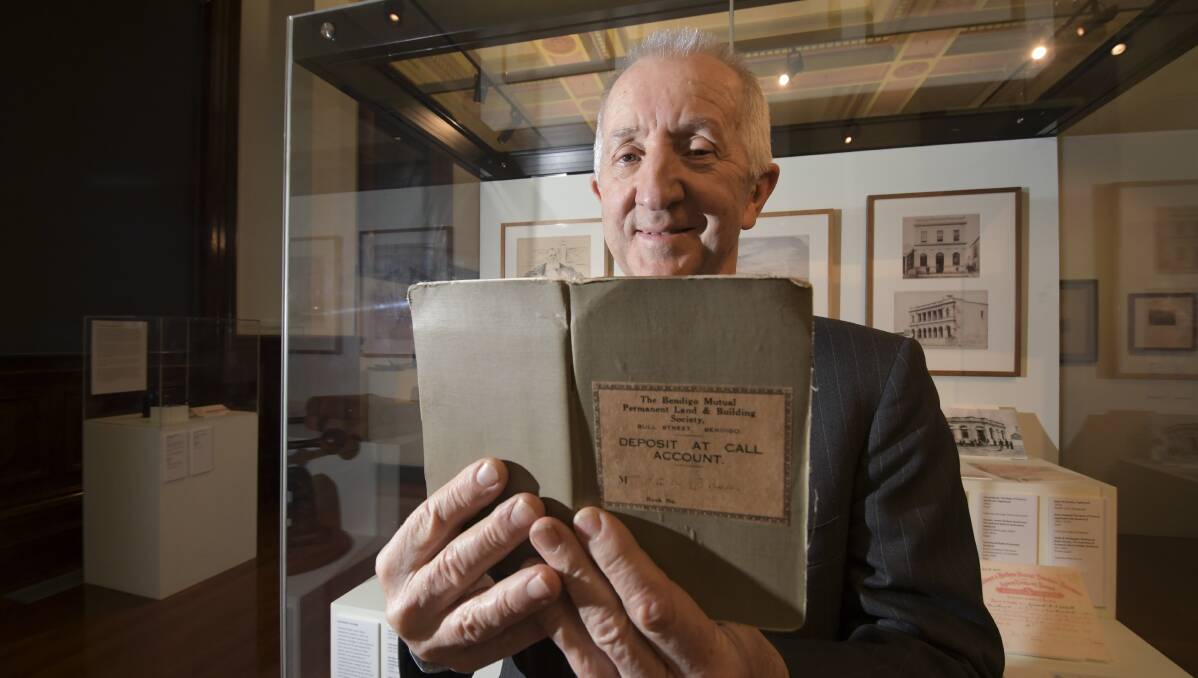

In 31 years on the Bendigo Bank board Robert Johanson has seen banking change beyond recognition. And as banks face the digital age, he thinks they'll have to change again.

Subscribe now for unlimited access.

or signup to continue reading

But Mr Johanson won't be the one handling it this time.

He will step down as chair of the board in October, to be replaced by Jacqueline Hey.

Read more:

All banking was done in the branch when Mr Johanson joined the board of what was then the Bendigo Building Society in 1988. He remembers going into the bank every week on a Friday to withdraw money.

Now people expect banking service instantly, wherever they are, at whatever time, on computer, mobile, phone or tablet.

Mr Johanson joined the board after completing a Masters of Business Administration in America. He'd grown up in Bendigo and attended Kangaroo Flat state school, before studying at university in Melbourne. His father, an accountant, was auditor for the building society, so he knew then chair Richard Guy, who invited him to join.

It's not just how people access cash that has changed in 31 years, the credit system has also altered dramatically.

Mr Johanson said banking was a lot freer and more accessible for the whole community now than 30 years ago.

He said credit available to more people had driven growth and prosperity.

In 1988 the banking sector was just starting to feel the effects of deregulation brought in by the Hawke-Keating Government, Mr Johanson said.

"Forty years ago, 50 years ago, financing for housing was essentially set each year in the budget. So the Commonwealth Government decided the amount of money that would be lent for housing and the price at which it would be lent," Mr Johanson said.

"Now credit is available in ways and in amounts that people couldn't have imagined years ago."

But cheap credit may have come at a cost. Mr Johanson said the availability of credit was very good for people, but low interest rates had artificially inflated asset prices.

He would like to see Australia return to a "more sensible" interest rate regime over time.

"The implications of making credit available at such low prices has been that we've seen asset values run up. The current consequence is that housing is becoming unaffordable, which is I think a serious problem," Mr Johanson said.

"I hear things like, 'Oh we've just got to make credit easier', or 'We've got to provide subsidies'. I'm very concerned when I hear those sort of responses, because I think they're not really solving the problem, they're just making it worse."

The range and the diversity of the people who now work for us is far far greater, and I think the place is much better for it.

- Robert Johanson

When Mr Johanson joined the board, the Bendigo Building Society employed maybe 100 people, with a few branches in Bendigo, Mildura and Melbourne. He was the only member to not live in Bendigo.

Now it has 650 branches and community banks around the country, employs about 1200 people in Bendigo, and is the fifth biggest bank in Australia.

It became a bank in the 1990s, after the Pyramid Building Society went broke. Mr Johanson said this caused a huge disruption to the industry, with the Bendigo Building Society the only society remaining solvent in Victoria. With government help, it took over what remained, and consolidated it in Bendigo.

Mr Johanson said the bank's firm anchorage in the community has been crucial to its success.

He said the board had never forgotten the purpose of the institution: to provide a secure, reliable place for people to put their savings, to build long term relationships with customers, and to support the prosperity of communities.

"Being headquartered in a place like Bendigo is really important to that. If you're the CEO of a major bank whose headquarters are in Melbourne or New York, you're a world away from the day to day, you don't have to run into your customers all the time," Mr Johanson said.

"Whereas for Marnie, people know who she is when she walks down the street, or goes to the football."

Read more:

This connection to its purpose is what helped the bank avoid the temptations to which others may have succumbed, Mr Johanson said.

The Royal Commission into banking misconduct report released in February dammed the structures within the big four banks, and many other Australian financial institutions. But it was largely positive about Bendigo Bank's practices.

Mr Johanson said the problems the Royal Commission highlighted were caused by "quick win" behaviours, where short term demands of investors were put ahead of the long term interests of customers.

Into the future Australia needed a more competitive market, where customers have more power, and can take more responsibility, he said.

Banks faced the challenge of transforming themselves for the digital world, like all industries, Mr Johanson said.

Customers used to dealing with Amazon and Google now had expectations of instant service, and instant information. But they also still wanted to know there was a real person in a bank branch if they need it.

"How do we do that in a world where no one wants to use branches anymore? ... In a world where your communication with the bank is almost entirely electronic and remote... how does trust play itself out in that kind of world?," Mr Johanson said of the challenge.

When Mr Johanson joined the board, there were no women on it, nor in senior management positions.

Now he will be succeeded in his role by a woman. In his view, this shouldn't be as noteworthy as it is.

"The range and the diversity of the people who now work for us is far far greater, and I think the place is much better for it," he said.

A new chief executive for the bank - Marnie Baker was appointed in 2018 - meant it was a good time for him to step down, Mr Johanson said.

With people like Marnie Baker and Jacqueline Hey at the helm, he was confident in the bank's continued success.

"It's a good time for me to say, 'We know what the big issues are in the next period', [and] put the place in the hands of people who'll be around to see that through," Mr Johanson said.

"It's been a fantastic job. I've enjoyed the whole time. It's been a huge honour and privilege. And I'm a great believer in the organisation and the people, it's been an absolute pleasure to work with so many people for some time."

Have you signed up to the Bendigo Advertiser's daily newsletter and breaking news emails? You can register below and make sure you are up to date with everything that's happening in central Victoria.